My First Experience as an Attorney for Property and Finance

I want to start this blog with an admission: although I’ve spent years drafting lasting powers of attorney and managing the process of creating them for clients, I have never actually been an attorney for property and finance myself - until now.

I’ve supported loved ones in crisis through a health and welfare lasting power of attorney, and I know first hand how invaluable these documents are. But stepping into the role of attorney for property and finance has been a completely different journey and a steep learning curve.

The blog will start by explaining what a Lasting Power of Attorney is, then describe the nuance involved in being an attorney for Property and Finance. With the scene set, I will then share what my experience has been so far and close with key takeaway messages.

What is a Lasting Power of Attorney?

A lasting power of attorney (LPA) is a legal document that allows a person (the donor) to nominate one or more people (the attorneys) to support them in making decisions - or to make decisions in their best interests - if they lose capacity to do so themselves. Lasting Powers of Attorney are set out within the Mental Capacity Act 2005 .

Capacity is time and decision-specific. It is not something you either “have or don’t have.” And while capacity is often associated with older age, it can just as easily be lost suddenly through accident or illness as well as a long-term health condition.

You can find out more about capacity in the podcast: Mental Capacity: it’s decision specific not a binary concept with Dr Maggie Keeble

There are two types of LPA:

Health and welfare – covering decisions about care, treatment, and living arrangements.

Property and finance – covering decisions such as managing pensions, income, benefits, paying bills, selling a home, or handling investments.

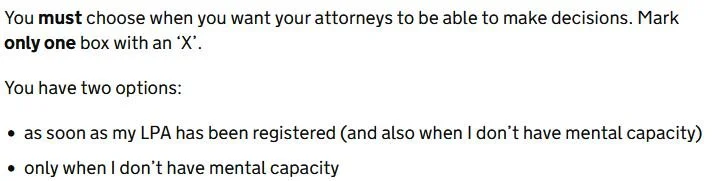

This blog focuses on Property and Finance Lasting Powers of Attorney. Unlike Health and Welfare Lasting Powers of Attorney, which can only be used if the donor loses capacity, a Property and Finance LPA can take effect as soon as it is registered with the Office of the Public Guardian. This means attorneys can walk alongside a donor - supporting them rather than taking over—long before capacity is an issue.

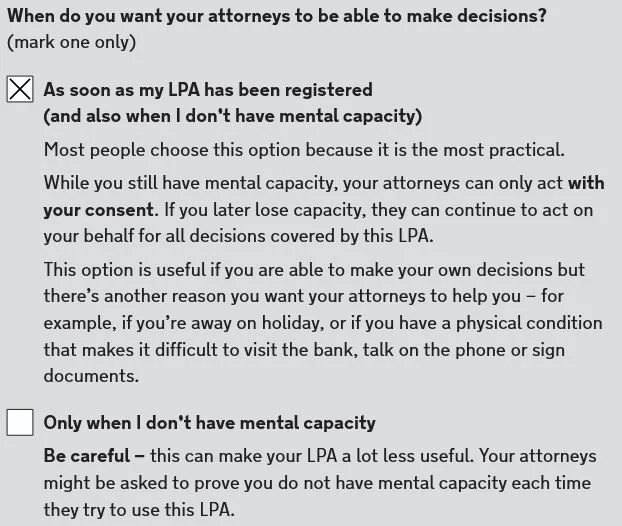

The decision on when attorneys can make decisions is made at the time of drafting the LPA, and you can access information about this in the form LP12 Make and register your lasting power of attorney. This is information you will see on the LP12:

My Experience as an Attorney

I have been nominated as an attorney, along with another family member, for a person in our family. When the person, (or donor), set up the Lasting Power of Attorney, they selected for us to be able to make decisions as soon as the document was registered – this is how the text looks the Lasting Power of Attorney:

Example text from a Property & Finance Lasting Power of Attorney

Having the option to walk alongside the donor or co-manage finances has been invaluable. The donor has capacity; however, they have physical disabilities making it exceptionally difficult to read information. They have no internet or means of accessing on line information and also live a considerable distance away.

Becoming an attorney for property and finance has brought me into contact with different companies, each of which has their own systems for recognising and registering LPAs. I want to share three experiences to illustrate how varied these processes can be.

1. Halifax (Banking)

My experience with Halifax has been exemplary. They have a dedicated support line with a team who handled my enquiries with professionalism and compassion.

The process was thorough - as it should be. Managing someone else’s finances is a serious responsibility, and proper checks are essential. Halifax’s system using the digital access code was straightforward and efficient. Every person I dealt with in the dedicated team was professional as well as compassionate.

2. An Insurance Company (Unnamed)

My dealings with one insurance provider have been much less smooth. Although they accepted the digital access code, it took around three weeks for the authorisation to be processed. The lack of a centralised team meant the process was far from seamless, making the experience unnecessarily stressful.

3. BT (British Telecom)

BT’s approach has raised particular concerns for me. Their published guidance states:

“Once we are satisfied that someone’s attorney…we’ll treat them as the account holder. In other words, the donor will no longer be able to manage their account. So if you’re the donor, please make sure you’re ready to hand over control of your BT account to your attorney before you apply.”

This emphasis on “handing over control” troubles me. A Property and Finance LPA should not automatically mean the donor loses involvement. The Mental Capacity Act is clear: attorneys should support the donor to make their own decisions wherever possible, not simply take over. In my view, BT’s current stance risks undermining that principle, and I’ll be exploring this further.

What I’ve Learned So Far

This first chapter in my attorney journey has highlighted just how inconsistent the processes are across organisations. Some have embraced digital access and treat attorneys with compassion; others make management unnecessarily complex.

Looking back on my first experiences as an attorney for Property and Finance, there are some lessons I want to share. These may sound like common sense, but living them day-to-day has shown me how important they are.

1. Involve the person

This is the cornerstone of the Mental Capacity Act. Being an attorney does not mean taking over someone’s life or choices. Wherever possible, involve the donor in decisions.

Talk to them about what’s happening.

Ask for their views and preferences.

Present information in a way they can access — that might mean large print, simplified language, or breaking things down into smaller steps.

Respect that they may want to remain as hands-on as possible, even if you’re formally registered to act.

Supporting decision-making is very different from replacing it.

2. Keep financial accounts

Technically, attorneys don’t have to maintain full sets of accounts (unlike Court Appointed Deputies who need to submit annual accounts), but in practice, I’ve found it invaluable.

I keep detailed records of every transaction I make on behalf of the donor.

I note dates, amounts, and reasons for payments.

I keep receipts and bank statements organised.

This isn’t just about transparency in case anyone asks. It also gives me peace of mind that I can account for every decision I’ve made.

3. Stay organised with a contact log

The sheer admin involved in being an attorney is overwhelming. Between banks, insurers, utilities, benefits offices, and countless smaller organisations, you will be asked for the donor’s details repeatedly. I now keep a dedicated spreadsheet that includes:

Names of every organisation.

Account numbers, customer IDs, policy numbers.

Contact details of departments and individual staff I’ve spoken to.

Notes of every conversation, including dates and follow-up actions.

Basic personal details for the donor (name, date of birth, address), so I’m not scrambling each time I’m asked.

This single document has been a lifesaver. It saves time, reduces stress, and helps me keep track of what’s outstanding.

4. Prepare for it to be exhausting

I didn’t expect how draining this role would be. You’re juggling practical admin, legal responsibilities, and the emotional weight of managing someone else’s affairs alongside a day job and family life. Some days it feels relentless. Having systems in place (like the spreadsheet and clear accounts) has been the only way to make it manageable.

5.Divide and conquer

I’m lucky, I am a co attorney acting with another. We can act “jointly and severally” meaning either one of us can make decisions independently of the other so we share the financial management and decision making involved in our role as attorneys. We keep each other to account, use our strengths to work out who does what in the complex support of another person’s life.

To Be Continued

This is just the start of my journey as a Property and Finance attorney. I plan to add blogs with further reflections and practical experiences as I go. For now, I hope sharing these early insights helps others who are starting out on an attorney path.